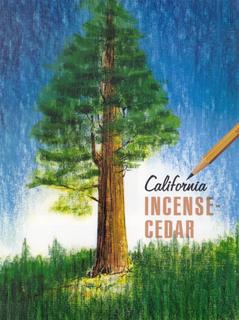

The second in a series of posts on California Incense-cedar, its historical and current use in the pencil industry; it’s conversion to pencil slats, finished pencils as well as other products; and important aspects of it’s growth and management as a timber resource in U.S. western forests. My last post covered the key reasons for the transition from Eastern Red Cedar to Incense-cedar as the premier wood species used for pencils. Today I deal with the growth and abundance of Incense-cedar in our forests.

The second in a series of posts on California Incense-cedar, its historical and current use in the pencil industry; it’s conversion to pencil slats, finished pencils as well as other products; and important aspects of it’s growth and management as a timber resource in U.S. western forests. My last post covered the key reasons for the transition from Eastern Red Cedar to Incense-cedar as the premier wood species used for pencils. Today I deal with the growth and abundance of Incense-cedar in our forests.

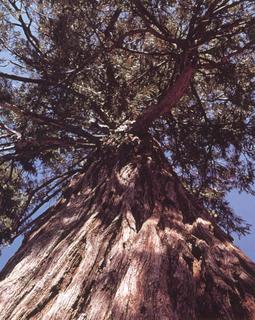

Incense-cedar is a hearty, drought-tolerant species that grows in a variety of soils in abundance throughout it’s natural growing range of the inland forests of central and northern California (as Calocedrus decurrens) and in southern Oregon (as Libocedrus decurrens). Though widely distributed in elevation it flourishes within the 2,000 to 6,900 foot (610 to 2,100 meter) elevation range.

Unlike species that occur in groves, Incense-cedar can be found scattered  among Douglas-fir, Jeffrey Pine, ponderosa pine and other species that dominate the mixed-conifer forest. Within the state of California, Incense-cedar generally comprises about 5% of the trees in a stand while just 1.5% in it’s southern Oregon growing range. Despite it’s popularity in a range of uses, Incense cedar has never become a mono-cultural plantation species as with other commercial western softwoods. As a prolific seed-cone producer it readily regenerates and proliferates throughout it’s growing range aggressively repopulating any available site on the forest floor. It’s germination and survival rate are excellent relative to other softwoods.

among Douglas-fir, Jeffrey Pine, ponderosa pine and other species that dominate the mixed-conifer forest. Within the state of California, Incense-cedar generally comprises about 5% of the trees in a stand while just 1.5% in it’s southern Oregon growing range. Despite it’s popularity in a range of uses, Incense cedar has never become a mono-cultural plantation species as with other commercial western softwoods. As a prolific seed-cone producer it readily regenerates and proliferates throughout it’s growing range aggressively repopulating any available site on the forest floor. It’s germination and survival rate are excellent relative to other softwoods.

Given historical tendencies to manage for more commercially desirable species on private timberlands the greatest abundance of Incense-cedar is found on public timberlands in our National Forests. However, due to it’s aggressive growth and increasing trends towards selective harvest methods and multi-layered forest canopies, Incense-cedar has experienced a growing importance on private timberlands in second and third growth forests. As a result there is more Incense-cedar growing in California forests today than at any time during the past 50 to 70 years based upon data from the US Forest Service mandated Forest Inventory and Analysis Project.

Despite the strong natural regeneration of Incense-cedar and the fact that it is not typically considered one of the more important commercially managed species, managed reforestation of  the species is also practiced by both governmental agencies and private interests. In California and Oregon there are numerous nurseries which grow Incense-cedar saplings for reforestation purposes. Significant research has also been carried out on such issues as genetic diversity, adaptability, insect resistance and survivability with respect to Incense-cedar. The application of the knowledge gained through years of research assures improved forest health and a continued sustained availability of Incense-cedar.

the species is also practiced by both governmental agencies and private interests. In California and Oregon there are numerous nurseries which grow Incense-cedar saplings for reforestation purposes. Significant research has also been carried out on such issues as genetic diversity, adaptability, insect resistance and survivability with respect to Incense-cedar. The application of the knowledge gained through years of research assures improved forest health and a continued sustained availability of Incense-cedar.

My next post in this series will cover the specific regulatory issues for National Forests and within the state of California that provide further support to assure Incense-cedar and other western species remain part of a healthy, sustainable, diverse and multiple use forest ecosystem.

(Note: Most of the information for this post was sourced from “A guide to Incense-cedar” published in 1992 by P&M Cedar Products, Inc. following extensive research into a wide range of data and information resources about the species.)

This post continues a series of Timberlines articles discussing the impact various world trade issues and practices have upon the Pencil Industry. In my previous

This post continues a series of Timberlines articles discussing the impact various world trade issues and practices have upon the Pencil Industry. In my previous